This report examines how the Queensland Government is managing its debt and investments and reports on some recent transactions relating to these. It also discusses associated risks and how these relate to the work of government entities.

Table of contentsIn providing services to the state and community, government entities may use debt to fund investment in assets, such as building infrastructure, or invest money to meet obligations, such as those relating to superannuation.

The Queensland Government holds significant investments that it can use to meet the state’s long-term liabilities or to fund future initiatives. One example is the Queensland Future Fund that was established to offset state debt.

Tabled 29 May 2023.

This report examines how the Queensland Government is managing its debt and investments and reports on some recent transactions relating to these. It also discusses risks associated with the debt and investments and how these relate to the work of government entities.

In 2021–22, positive economic factors meant net debt (financial liabilities minus financial assets) decreased. This contrasted with recent years, when the government borrowed more to stimulate the economy.

The government expects its net debt to increase over the next 4 years, as it uses borrowings to cover the cost of infrastructure and other major initiatives. Significant announcements have also been made about infrastructure to be delivered up to 2035, with funding for these projects to be included in future budgets.

Interest rates have risen, which will affect the associated expenses – particularly for new borrowings. This will have an impact on the government’s fiscal principles relating to debt management, specifically the ratio of net debt to revenue (‘fiscal’ refers to government spending, revenues, and/or debt). Over the coming years, this is expected to become more of an issue, as borrowings are expected to increase and will be at a higher interest rate.

The government holds investments across several entities, mainly to help fund future obligations it is required to meet. In recent years, the macroeconomic impacts of responses to COVID-19 and other geopolitical events have caused additional volatility across investment portfolios.

Many of the entities holding investments – namely, the insurance entities within government – are facing extra challenges due to an increase in the cost of services they fund. For example, there have been significant increases in the cost of building materials and medical services.

These entities need to ensure they have enough investments to fund their liabilities, as they fall due.

The Queensland Future Fund – Debt Retirement Fund was established in 2020–21, and it diversified its investments in 2021–22. It did this by investing into different types of assets, in line with the strategy set for its portfolio. It did not pay down any government debt during the year, but it was used to offset state debt and support Queensland’s credit rating. There was a small decrease in its value from $7.742 billion as at 30 June 2021 to $7.718 billion as at 30 June 2022.

Historically, the Residential Tenancies Authority has relied on investment returns to fund its operations, but this has been affected by market volatility for multiple years. At the end of 2021–22, it sold its investments to the government and received the equivalent value in cash in return. Its operations will now be funded through annual grants.

In our report on the establishment of the Queensland Future Fund, we recommended that Queensland Treasury include further detail on the funds established under the Queensland Future Fund Act 2020 (the Act), by amending the Act to require:

Queensland Treasury responded that the Queensland Future Fund is not an entity of itself, and therefore, does not warrant separate financial statements. We noted in State finances 2021 (Report 13: 2021–22) that we would work with it on how to identify and implement options to enhance financial statement disclosures on the activities of the Queensland Future Fund.

The 2022 audited financial statements for Queensland Treasury included further details on the composition and activities of the Queensland Future Fund. Information is also included in the Queensland Treasury Corporation’s financial statements, as it holds the underlying fund managed by QIC Limited. We will continue to monitor the activities of the fund and the level of disclosure through the reporting currently being provided.

In accordance with s.64 of the Auditor-General Act 2009, we provided a copy of this report to relevant entities. In reaching our conclusions, we considered their views and represented them to the extent we deemed relevant and warranted. Any formal responses from the entities are at Appendix A.

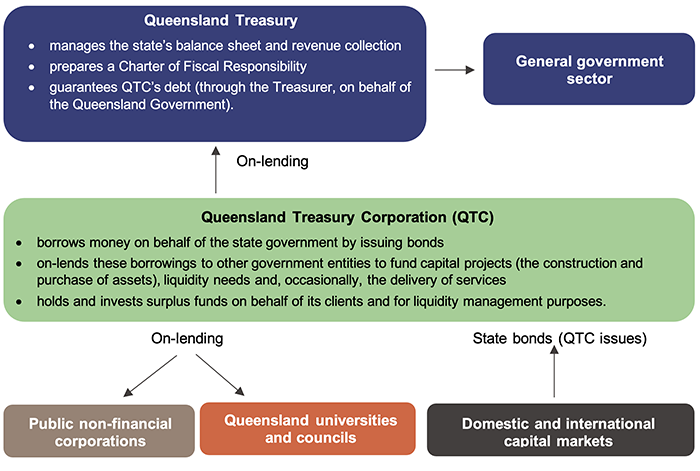

This report examines how the Queensland Government manages its debt and investments, including the associated risks. Three Queensland Government entities are heavily involved in managing the state’s debt and investments:

Queensland Treasury advises QTC how much borrowings the state requires and QTC identifies the most appropriate way to raise these funds in both domestic and international capital markets. Once QTC has raised the necessary funds, QTC on-lends this to public sector entities.

Entities within government are involved in providing services to Queenslanders. In doing so, they may use debt to fund investment in physical assets (for example, the construction of infrastructure), and invest money to meet obligations (like those relating to superannuation and insurance) over a longer period. These entities fit within 3 sectors of the Queensland Government, as shown in Figure 1A.

Composition of the Queensland GovernmentNotes : The orange outlines denote the non-financial public sector, which is a combination of the general government sector and public non-financial corporations sector.

Compiled by the Queensland Audit Office.

In addition, some other public sector entities that are not within the Queensland Government (such as universities and local governments) hold borrowings and investments with QTC and QIC.

This chapter analyses the Queensland Government’s net debt position, including who holds the borrowings, and how net debt is measured and managed.

DefinitionMost borrowings are monies received from lenders with the agreement that the amounts borrowed will be repaid. Queensland Treasury Corporation (QTC) borrows money on behalf of Queensland public sector entities, so our analysis focuses on these borrowings. Other types of borrowings include leases over physical assets, and contracts to protect against movements in interest rates, electricity prices, and foreign currency exchange rates.

Net debt is calculated as financial liabilities (including deposits held, advances received, borrowings with QTC, leases and other loans, and securities) minus financial assets (including cash and deposits, advances paid, loans paid, and investments).

Queensland Treasury, as part of its fiscal management role within the state, identifies and manages how ongoing operating expenses, as well as capital expenditure (money spent to purchase or construct new assets or improve the performance of existing assets), should be funded. Entities in the public non‑financial corporations sector typically use borrowings to fund the construction of large infrastructure projects. This maintains the government’s desired capital structure for these entities (the right mix of debt and government investment to finance their operations and growth).

The state also looks to fund its operations and a significant portion of its capital expenditure from the revenue it earns. However, there may be periods when borrowings are required to fund its day-to-day activities. For example, during the COVID-19 pandemic, the state used borrowings to support economic activity.

Queensland Treasury identifies the borrowing requirements for the state through the budget process. Queensland Treasury Corporation (QTC) facilitates the raising of debt by issuing bonds (a loan for a specific period, with regular interest payments made over the period, and repayment in full at the end) to both the domestic and international capital markets. It then lends this (on-lends) to Treasury or other government entities. Treasury uses the amounts borrowed to fund government programs or projects through appropriations to entities in the general government sector.

QTC also provides these services to public sector entities that are not within the Queensland Government (such as universities and councils) and entities within the public non-financial corporations sector, who identify their own borrowing needs. The roles of Queensland Treasury and QTC are outlined in Figure 2A.

Roles of Queensland Treasury and Queensland Treasury Corporation in managing debt

Compiled by the Queensland Audit Office.

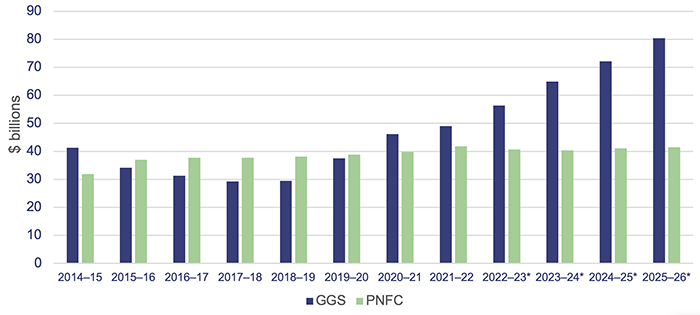

Figure 2B shows the amounts owed to QTC at 30 June each year by the general government sector and public non-financial corporations sector, along with projected borrowings over the forward estimates to 2025–26 for these 2 sectors. As at 30 June 2022, these 2 sectors represent 89 per cent of total debt held with QTC. The remaining 11 per cent predominantly relates to borrowings held by universities and local governments.

Most general government sector entities (departments and statutory bodies) receive most of their revenue from appropriations and grants. Queensland Treasury borrows money from QTC on their behalf, to provide funding for programs or projects in the general government sector. These borrowings with QTC are forecast to increase over the forward estimates as the state invests in its infrastructure program.

Public non-financial corporations sector borrowings are primarily held by entities with income-generating assets. Total borrowings are forecast to remain stable over the forward estimates. These have not changed significantly since the government implemented its Debt Action Plan in 2015–16.

The implementation of the government’s debt action plan reduced borrowings by $7.6 billion in the general government sector. Funds to reduce borrowings came largely from 2 transactions:

Figure 2B also shows the decrease in general government sector borrowings and increase in public non‑financial corporations sector borrowings at this time.

General government sector and public non-financial corporations sector borrowings with QTC

Note: * Denotes budgeted amounts. GGS – general government sector; PNFC – public non-financial corporations sector.

Compiled by the Queensland Audit Office.

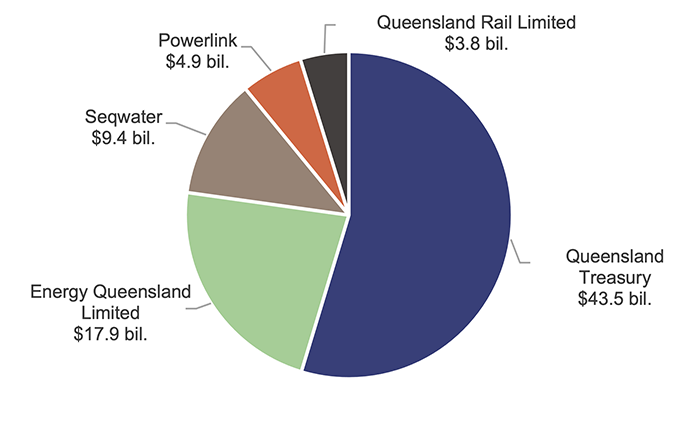

As mentioned, QTC on-lends to Queensland Government entities to fund the delivery of assets and services. Figure 2C shows the top 5 Queensland Government entities with borrowings from QTC, as at 30 June 2022.

Top 5 entities with borrowings from QTC as at 30 June 2022

Compiled by the Queensland Audit Office from QTC financial information.

As at 30 June 2022, Queensland Treasury had $43.5 billion of borrowings from QTC. It uses these borrowings to support government departments and other government entities (such as hospital and health services). Most of it is for the state infrastructure program and economic development and, in recent times, for response to the COVID-19 pandemic .

Each of the other 4 entities has significant infrastructure portfolios to deliver services. They use debt financing as a source of funds to support investments in renewing and increasing this infrastructure, and to maintain a desired capital structure (the right mix of debt and government investment to finance their operations and growth). They use their revenue to pay these debts.

The state budget is focused on the general government sector. As part of the budget-setting process, the government outlines its fiscal objectives and the fiscal principles that support them. The state budget is developed in line with these principles each year.

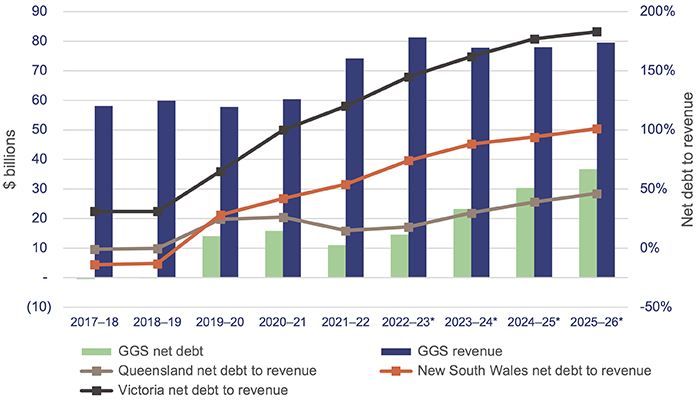

The government assesses the sustainability of government debt by comparing the level of net debt (financial liabilities minus financial assets) to the revenue it earns each year, referred to as the ‘net debt to revenue ratio’. The budget includes a fiscal principle aimed at ensuring the general government sector net debt to revenue ratio is maintained at sustainable levels in the medium term (usually between 4 to 10 years) and targeting reductions in the net debt to revenue ratio in the long term.

Figure 2D shows the trend of the net debt to revenue ratio for the general government sector. It also shows that the ratios are expected to worsen over the next 4 years as the state continues to invest in its economic recovery and capital infrastructure programs. For comparison, the chart also includes comparative net debt to revenue ratios for the New South Wales and Victorian governments. This shows that while the ratios increase in line with the growth in borrowings, they do so at a lower rate than 2 other state governments.

Net debt to revenue ratios 2017–2026

Note * Denotes budgeted amounts. GGS – general government sector.

Compiled by the Queensland Audit Office, from Queensland Treasury; NSW Treasury; and Department of Treasury and Finance, State of Victoria information.

If the government identifies that changes are needed to manage debt levels, it can take action that includes:

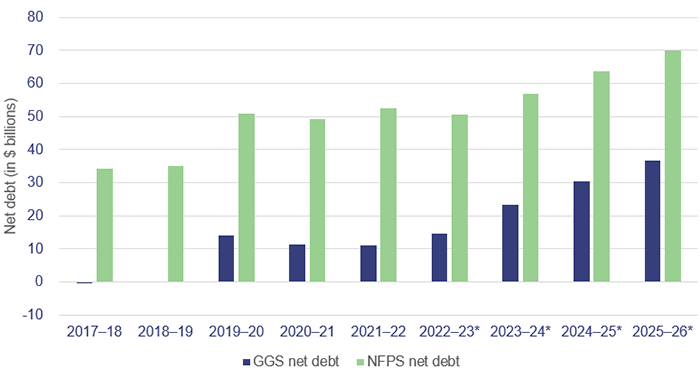

Figure 2E shows the net debt for the general government sector and the non-financial public sector since the 2017–18 financial year, alongside projected net debt.

Net debt for the general government sector and the non-financial public sector

Note: Years marked with an * are projected figures, from the 2022–23 Budget Update. GGS – general government sector; NFPS – non-financial public sector, which includes the general government sector and the public non-financial corporations sector.

Compiled by the Queensland Audit Office.

Net debt for the general government sector was forecast to increase by $8.2 billion in 2019–20. This was due to additional borrowings to fund capital projects (for example, transport infrastructure including Cross River Rail) and the recognition of lease liabilities (for example, leases over office accommodation on implementation of a new accounting standard). Net debt was higher than forecast mainly due to the COVID-19 pandemic, with macroeconomic factors and the government response impacting r evenues, expenses, and investment values. Prior to this, the focus of the government had been on reduction of debt, particularly for the general government sector.

In recent years, the government has focused on measures to manage net debt, in light of the unexpected additional borrowings it needed. This included creating the Queensland Future Fund – Debt Retirement Fund to provide for future debt reduction and offset state debt to support Queensland’s credit rating. In QTC’s 2022 annual report, it reported that the credit rating agencies had reaffirmed the state’s and QTC’s credit ratings.

In addition, the savings and debt plan was announced in 2020. This plan targeted savings of $3 billion over 4 years to 2023–24. The Queensland Budget 2022–23 identified this target has been met. These savings represented amounts by which departments’ appropriations were reduced in budgets from 2020–21 and over the forward estimates.

In 2021–22, favourable economic conditions (with higher revenue from coal royalties) have also assisted in managing the debt balance. The improved conditions have meant the government borrowed less than budgeted in 2021–22, as there were more operating cash flows to fund planned capital expenditure.

The 2022–23 Budget Update forecasts a continued increase in borrowings over the forward estimates to 2025–26, although less of an increase than was forecast in the 2021–22 budget. More borrowings are currently expected, based on the need to fund capital investments beyond maintenance and replacement.

The capital program across government is projected to be $64.8 billion between 2022–23 and 2025–26, a significant increase of $12.6 billion on the 4-year capital program outlined in the Queensland Budget 2021–22.

This includes an additional $4 billion over the next 4 years as part of the new $62 billion Queensland Energy and Jobs Plan, which the Queensland Government released in September 2022. This investment was partially funded through higher revenue from coal royalties in 2021–22. The full plan will be delivered through a mix of private and public sector investment, with the energy system to remain majority owned by the people of Queensland.

The capital program and budget do not yet include all future projects for the Brisbane 2032 Olympic and Paralympic Games. As the detailed planning for energy projects and the games progresses and as information on funding sources, costs, and timing become available, this will be reflected in future budgets.

The majority of general government sector debt (borrowed by QTC and on-lent to Queensland Treasury) is held under fixed (rather than variable) interest rates. Higher inflation has brought forward the timing and number of expected cash rate increases in 2022 and 2023 by the Reserve Bank of Australia. These interest rate increases were anticipated in the 2022–23 Budget Update.

The impact of interest rate variations in the short term is not expected to be significant, but as new borrowing arrangements are entered into at current rates, the interest expense is expected to increase. The 2022–23 Budget Update estimates interest expenses to be $1.8 billion in 2022–23, an increase of $245 million (16.2 per cent) on 2021–22. Comparing interest expenses to operating revenue provides information on the share of revenue that must be devoted to servicing debt costs.

Figure 2F shows that this ratio is projected to increase over the forward estimates. In 2021–22, 2 per cent of the general government sector’s operating revenue was needed to service the cost of debt, with the lower percentage also associated with higher revenue in that year. This is estimated to increase to over 4 per cent by 2025–26.